Best Mortgage & Real Estate Guide: How to Choose the Right Lender, Attorney & Investment Strategy

Introduction

The mortgage and real estate market continues to be one of the most profitable sectors globally. With rising housing demand, property investment opportunities, and affordable home loan programs, both buyers and investors are actively seeking reliable information. Whether you are planning to buy your first home, looking for a mortgage refinance, or exploring real estate investment trusts (REITs), this guide covers everything in detail.

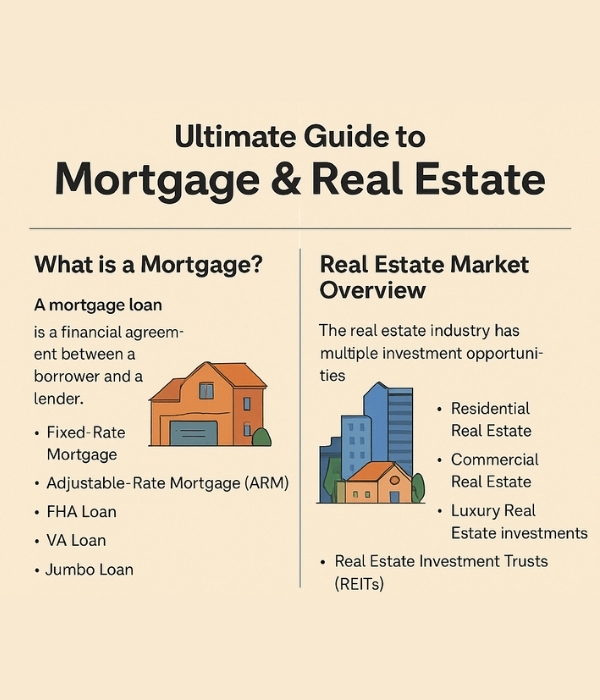

What is a Mortgage?

A mortgage loan is a financial agreement between a borrower and a lender, usually a bank or mortgage company, where the property is used as collateral. Common types of mortgages include:

- Fixed-Rate Mortgage (stable monthly payments)

- Adjustable-Rate Mortgage (ARM)

- FHA Loan (ideal for first-time buyers)

- VA Loan (for veterans)

- Jumbo Loan (for luxury homes)

Real Estate Market Overview

The real estate industry offers multiple investment opportunities:

- Residential Real Estate (buying and selling homes)

- Commercial Real Estate (offices, retail spaces)

- Luxury Real Estate Investments

- Real Estate Investment Trusts (REITs)

The U.S. real estate market is worth trillions of dollars, making it one of the most valuable and stable investment choices.

Refinance Mortgage Rates

Refinancing your mortgage can save thousands of dollars in interest payments. Many homeowners search for the best refinance mortgage rates to reduce their monthly payments or switch from an adjustable-rate mortgage to a fixed one. Always compare rates from top mortgage lenders near you before making a decision.

Best Mortgage Lenders Near Me

Choosing the right lender is critical. Top banks and credit unions compete to offer loans to first-time buyers, investors, and those with bad credit. When searching for the best mortgage lenders near me, consider:

- Loan types (FHA, VA, Conventional)

- Interest rates

- Closing costs

- Customer reviews

Reverse Mortgage Calculator

For seniors, a reverse mortgage allows converting home equity into cash. A reverse mortgage calculator helps estimate eligibility and monthly payments. This option is popular for retirees who want financial flexibility without selling their property.

Commercial Property Loan

Real estate investors and businesses often need commercial property loans to expand operations. These loans typically have different terms than residential mortgages, with higher interest rates and larger down payment requirements.

Real Estate Attorney Near Me

Buying or selling property involves legal complexities. Hiring a real estate attorney near me ensures the contracts, title search, and closing process are handled properly. Attorneys also help with disputes, foreclosures, and property rights.

Mortgage Refinance Attorney

A mortgage refinance attorney helps protect your interests when renegotiating loan terms. They review contracts, explain hidden fees, and ensure the refinance process complies with state regulations.

Buy House With Bad Credit

Many potential buyers wonder if it’s possible to buy a house with bad credit. While challenging, FHA loans and subprime mortgage options make it possible. Improving credit scores and saving for a larger down payment also helps.

Home Equity Line of Credit (HELOC)

A home equity line of credit (HELOC) allows homeowners to borrow against the equity in their property. HELOCs are flexible, offering revolving credit similar to credit cards, but with lower interest rates.

Real Estate Investment Lawyer

Investors in commercial or residential properties often hire a real estate investment lawyer to handle contracts, partnerships, and legal risks. Since real estate deals involve millions of dollars, these lawyers are crucial for minimizing risk.

FHA Loan Requirements

First-time buyers frequently search for FHA loan requirements. FHA loans remain attractive because of low down payments (3.5%) and flexible credit requirements. However, they require mortgage insurance and strict property standards.

Mortgage Rates & How to Get the Best Deal

One of the most searched terms in finance is mortgage rates. Lenders offer different rates based on:

- Credit score

- Down payment amount

- Loan term (15-year vs 30-year mortgage)

- Location of property

To secure the lowest rates:

- Improve your credit score

- Compare lenders online

- Consider refinancing when interest rates drop

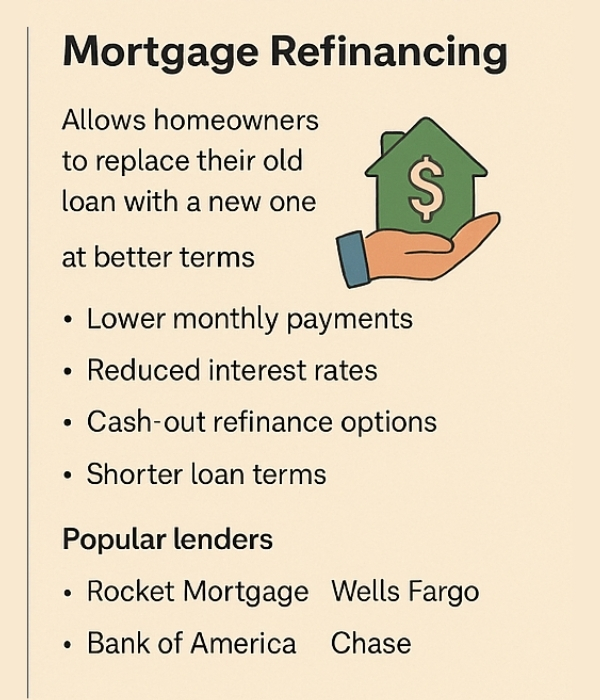

Mortgage Refinancing

Mortgage refinancing allows homeowners to replace their old loan with a new one at better terms. Benefits include:

- Lower monthly payments

- Reduced interest rates

- Cash-out refinance options

- Shorter loan terms

Best Mortgage Lenders

Choosing the best mortgage lenders is crucial for home buyers and real estate investors. Top lenders often provide:

- Low interest rates

- Fast approvals

- Flexible loan terms

- Online mortgage calculators

Some popular lenders include Rocket Mortgage, Wells Fargo, Bank of America, and Chase.

Read: best mesothelioma lawyer

Real Estate Investment Opportunities

If you are looking for passive income, investing in real estate properties or REITs is highly profitable. Key options include:

- Rental Properties (steady monthly cash flow)

- Vacation Homes & Airbnb Investments

- Commercial Property Investments

- Real Estate Crowdfunding Platforms

Mortgage & Real Estate Trends

- Digital Mortgage Applications are growing

- AI-based Real Estate Valuation tools are in demand

- Sustainable Housing & Green Mortgages are becoming popular

- Luxury Property Investments continue to dominate

Conclusion

The mortgage and real estate industry is not only about buying or selling property; it’s about making smart financial decisions. From choosing the right mortgage loan to exploring real estate investment opportunities, every step requires careful planning.